Discover Discounted Auto Insurance Fees in Chicago IL

Variables that Impact Car Insurance Policy Prices in Chicago IL

Elements that affect car insurance prices in Chicago, IL may vary commonly relying on numerous crucial elements. One considerable aspect is the driver's grow older and driving history, as much younger as well as unskilled drivers usually tend to have much higher costs due to an identified much higher risk of crashes. Furthermore, the area where the vehicle is actually stationed overnight may influence insurance coverage costs as particular areas might possess much higher crime fees or likelihoods of vandalism, resulting in improved fees.

Another important aspect is the form of vehicle being actually covered, as certain makes and versions might be more costly to fix or substitute in case of a collision, leading to much higher insurance coverage prices. Also, the regularity of vehicle utilization and yearly gas mileage can additionally impact insurance coverage costs, along with vehicles that are steered regularly and over longer ranges generally lugging higher premiums. It's important for drivers in Chicago, IL to be actually mindful of these consider purchase to bring in informed selections when picking car insurance policy protection.

Just How to Conserve Loan on Car Insurance Coverage in Chicago IL

There are actually many approaches that drivers may work with when it happens to conserving loan on car insurance policy in Chicago. To start with, keeping a clean driving record is actually critical. Avoiding visitor traffic violations and also mishaps can easily bring about Cheap auto insurance Back of the Yards chicago il lower insurance policy costs. Furthermore, packing insurance plan along with the very same company, including incorporating car and home insurance, can frequently cause reduced prices.

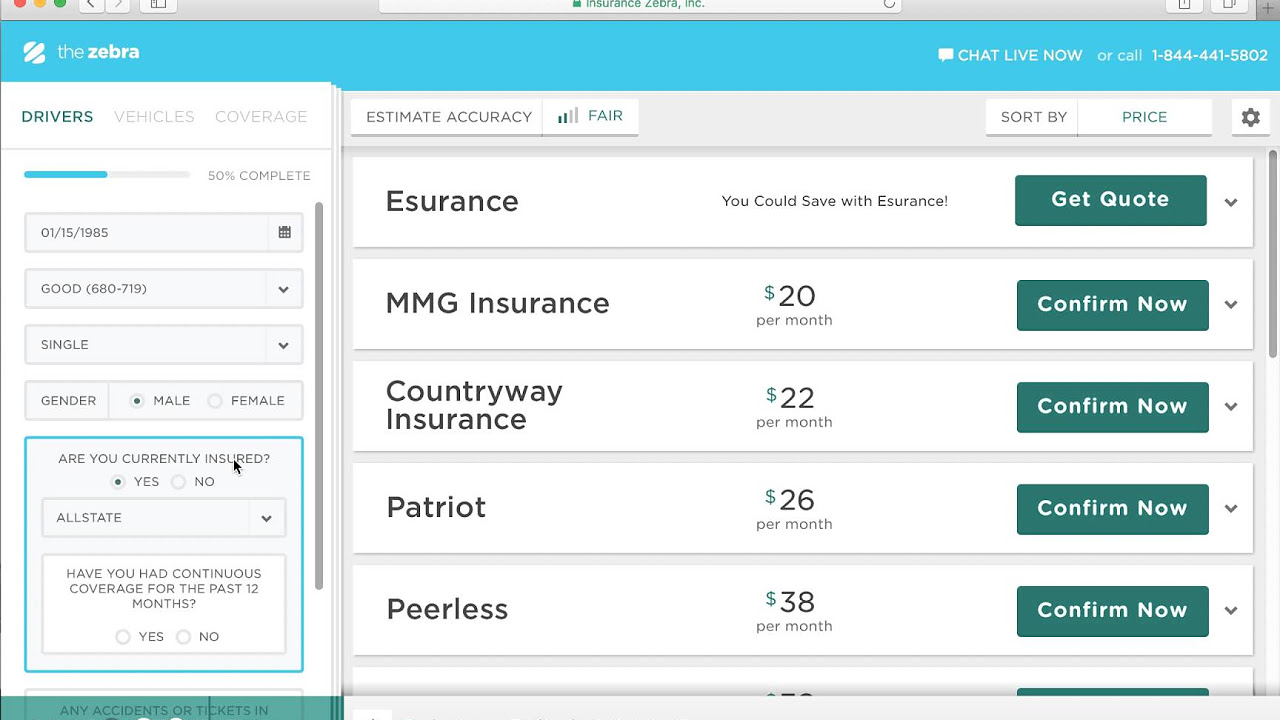

Another way to reduce car insurance is by deciding for a greater deductible. While this implies spending even more expense in case of a case, it may substantially reduce month-to-month superiors. Contrasting quotes coming from various insurance policy firms is actually likewise important in discovering the most ideal fee. Various insurance carriers may provide varying incentives as well as savings, therefore looking around can aid drivers pinpoint the most cost-effective option for their needs.

Understanding the Different Kinds Of Car Insurance Insurance Coverage

When it relates to car insurance coverage in Chicago IL, it is actually important to know the various styles accessible to guarantee you possess the necessary protection. Obligation insurance is a foundational coverage that aids purchase problems and also traumas to others in a mishap that you are actually lawfully in charge of. This coverage is actually required in Illinois and commonly features bodily trauma responsibility and residential or commercial property harm liability.

Tips for Contrasting Car Insurance Coverage Prices Quote in Chicago IL

When reviewing car insurance estimates in Chicago, IL, it is actually essential to acquire quotes from a number of insurance policy suppliers to ensure you are actually obtaining the very best coverage at a competitive rate. Begin through figuring out the protection styles as well as restrictions you need based on your specific requirements as well as finances. The moment you possess a crystal clear understanding of your necessities, begin requesting quotes from various insurance provider, being sure to deliver precise information to acquire the most precise estimates.

Additionally, keep in mind of any kind of discount rates you might be eligible for, like secure driver markdowns, multi-policy rebates, or even price cuts for having safety components in your vehicle. Matching up these discount rates across various insurance companies can easily aid you determine potential discounts options. Keep in mind to also consider the online reputation and customer care of the insurer, as you'll desire a supplier that not just offers budget-friendly costs but likewise provides trusted company when you need it most.

Savings Offered for Car Insurance Policy in Chicago IL

Lots of car insurance coverage companies in Chicago give a variety of rebates to assist drivers spare loan on their costs. These discount rates could be based on variables including possessing a good driving file, being a safe driver, possessing a car along with safety and security features, packing insurance coverage plans, or even being a student with good qualities. Through taking advantage of these markdowns, drivers may considerably minimize their insurance expenses while still preserving appropriate protection for their vehicles.

It is crucial for people finding car insurance in Chicago to ask about the price cuts that different insurance policy firms offer. Comparing the rebates offered coming from several providers can aid drivers locate the most effective bargain and likely conserve thousands of dollars on their superiors. Furthermore, some insurance coverage providers might give customized price cuts for specific careers, subscriptions, or even connections, creating it important to completely research all accessible options to find one of the most economical insurance coverage strategy.

Common Mistakes to Prevent When Searching For Car Insurance in Chicago IL

When purchasing car insurance in Chicago, it's important to stay away from usual blunders that might wind up costing you additional cash in the lengthy operate. Among the crucial oversights to steer clear of is actually neglecting to contrast quotes from different insurance provider. By certainly not exploring numerous possibilities, you might lose out on possible savings and better protection that another supplier can provide. Also, disregarding to review the plan information thoroughly may trigger distressing surprises eventually. It's necessary to understand what is covered, what is omitted, as well as any possible limitations or even stipulations within the policy to ensure that it aligns with your requirements and assumptions.

The Value of an Excellent Driving File for Lower Car Insurance Fees

Preserving an excellent driving report is vital when it comes to getting lower car insurance policy fees in Chicago, IL. Insurance provider usually award drivers that have a record of secure driving techniques with reduced premiums. A clean driving file, complimentary of collisions, traffic offenses, as well as insurance claims, displays to insurance firms that you are actually a low-risk driver, which can lead to lower insurance coverage costs. By abiding by website traffic rules, performing defensive driving approaches, and also avoiding at-fault mishaps, you can not just remain safe when driving however additionally likely spare cash on your car insurance policy.

However, a poor driving report, characterized by hastening tickets, incidents, DUI offenses, and also other violations, can cause increased insurance costs in Chicago, IL. Insurance service providers look at drivers along with a past history of high-risk habits as risky customers, making them even more susceptible to accidents as well as expensive insurance claims. As an outcome, people along with a damaged driving file may encounter higher costs as insurance carriers seek to minimize the prospective monetary threats connected along with covering all of them. As a result, sustaining a well-maintained driving document is actually integral certainly not merely for your protection when traveling yet also for securing economical car insurance policy fees in Chicago, IL.

How Your Vehicle Kind Influences Your Car Insurance Policy Superiors in Chicago IL

When it pertains to finding out car insurance policy costs in Chicago, the kind of vehicle you steer plays a significant part. Insurance provider take into consideration variables like the make as well as model of your car, its own grow older, safety components, as well as the possibility of theft when determining your prices. Normally, luxurious vehicles, cars, and high-performance vehicles often tend to possess greater insurance policy superiors as a result of their enhanced risk of incidents and also burglary.

On the other hand, even more trustworthy and inexpensive vehicles commonly include lesser insurance costs. Since they are viewed as less unsafe to cover, family-friendly cars, cars, and also vehicles with top protection rankings are actually often more affordable to cover. In addition, crossbreed and electricity cars and trucks might receive price cuts as they are actually thought about ecological as well as possess lower fixing expenses just in case of incidents. It's crucial to think about just how your vehicle selection can influence your insurance policy premiums when looking for protection in Chicago.

The Job of Deductibles in Your Car Insurance Coverage Policy in Chicago IL

When picking a car insurance coverage policy in Chicago IL is the part of deductibles, one crucial component to consider. A deductible is actually the volume of funds you acknowledge to spend out of pocket before your insurance policy protection boots in to cover the continuing to be prices of an insurance claim. Typically, the much higher the tax deductible you select, the lesser your insurance coverage fee are going to be. This means that picking a greater tax deductible may aid minimize your annual or even month to month car insurance coverage expenses, yet it additionally indicates you'll need to have the funds available to cover that out-of-pocket quantity in the unlikely event of an insurance claim.

It is actually vital to meticulously assess your financial scenario and also driving routines before choosing a deductible for your car insurance in Chicago IL. While choosing a much higher tax deductible can easily cause lower costs, it is very important to make sure that you can pleasantly pay for to pay that quantity if you need to have to create a case. However, picking a lesser tax deductible may suggest greater month to month fees, however it may deliver comfort knowing that you will not must cover a considerable out-of-pocket price in the unlikely event of an accident or even various other covered accident. Stabilizing your finances and also insurance policy demands is actually crucial when figuring out the ideal insurance deductible for your car insurance coverage in Chicago IL.

Comparing Regional Insurance Provider for the very best Rates in Chicago IL

When it involves comparing regional insurance coverage firms for the absolute best prices in Chicago, IL, it's necessary to consider multiple elements prior to deciding. Start by exploring the track record as well as client testimonials of each insurance service provider to gauge their level of company and also dependability. Additionally, contrast the insurance coverage possibilities as well as rebates offered by each firm to guarantee you are actually receiving one of the most worth for your funds. Consider that the cheapest superior may not consistently imply the very best coverage, so weigh the expense versus the perks supplied.

An additional important facet to think about when contrasting local insurance provider in Chicago, IL is their client assistance and asserts process. Appear for business that have a straightforward insurance claims method and also reactive customer support to help you by means of any kind of problems or even inquiries you may have. Look at getting to out to each insurance firm straight to make inquiries concerning any kind of added savings or tailored coverage possibilities that might not be actually promoted. Through taking the time to extensively contrast nearby insurance policy providers, you may discover the greatest rates as well as protection that satisfy your personal demands as well as budget plan in Chicago, IL.

Nearby Auto Insurance Agency

Insurance Navy Brokers

1801 W 47th St, Chicago, IL 60609