Affordable Car Insurance in Las Vegas NV

Recognizing Auto Insurance Policy in Las Vegas, NV

Auto insurance coverage is an important component of vehicle ownership for drivers in Las Vegas, NV. A car insurance policy supplies financial protection in the celebration of accidents, theft, or harm to cars. There are actually various kinds of coverage readily available, including collision coverage as well as comprehensive coverage, which deliver varying amounts of protection for vehicle drivers and also their motor vehicles. It is actually crucial for drivers to comprehend the regards to their policy as well as the coverage it offers to ensure they are effectively defended while driving. In addition, aspects like a driver's zip code can easily influence insurance policy costs, so it is very important to think about all parts when deciding on a policy from a respectable insurance coverage company that supplies affordable quotes and also prospective discounts.

Motorists in Las Vegas ought to make the effort to research as well as contrast quotes from multiple insurance suppliers to find the ideal coverage at a cheap cost. By discovering various possibilities as well as understanding the discounts on call, vehicle drivers can make knowledgeable decisions about their auto insurance policy. Aspects including the vehicle driver's zip code can easily influence the price of insurance fees, so it is actually vital to select a policy that matches both the vehicle driver's requirements as well as spending plan. Recognizing the different sorts of coverage, offered discounts, and just how a vehicle driver's location can easily affect premiums may aid people safeguard the appropriate auto insurance policy for their cars as well as driving routines in Las Vegas, NV.

What Is Actually Car Insurance and Why Do You Need It?

Car insurance policy is actually a kind of insurance policy that gives economic protection for people in the event that of accidents or even various other incidents while driving. Insurance companies deliver several products as well as coverage options, featuring bodily injury liability coverage and property damage liability coverage. These coverages aid make up for the costs of medical costs as well as fixings that may develop coming from mishaps while driving.

Possessing car insurance is actually a lawful need in a lot of conditions, consisting of Nevada, as well as driving without it can lead in fines or charges. Beyond satisfying lawful obligations, auto insurance is crucial for safeguarding yourself and others when traveling. A clean driving record can aid reduced insurance costs, as insurance companies commonly consider your driving history when finding out fees. In general, possessing the appropriate insurance coverage is actually crucial for making certain financial safety in the event of unforeseen crashes or damages while driving.

Nevada Auto Insurance Criteria

When driving in Nevada, including Las Vegas, auto insurance policy is an obligatory requirement. The minimum coverage needed by regulation for car insurance in Nevada is actually $25,000 for bodily injury or death of a single person in a crash, $50,000 for bodily injury or even death of two or even additional persons in a mishap, and also $20,000 for injury to or devastation of home of others in a crash. These minimum coverage requirements intend to make certain that drivers have monetary protection in the event they are at fault in an incident. Generally, the expense of satisfying these criteria falls within a practical variation, creating it necessary for drivers to abide by the regulation for each financial savings and also legal observance.

In Nevada, it is very important for motorists to sustain proof of insurance in any way opportunities while operating an auto. This proof of insurance coverage may be such as a physical insurance coverage card or even provided electronically by means of a mobile device. Failing to keep the needed coverage may lead to charges as well as fines, in addition to the possible economic dangers connected with driving without insurance. By satisfying the minimum coverage requirements, drivers certainly not just guard themselves coming from possible monetary liabilities yet likewise uphold their duty as a motorist to ensure the safety of others when driving.

Aspects Affecting Auto Insurance Rates in Las Vegas

Factors such as coverage options, coverage each, as well as the introduction of teen vehicle drivers in your auto policy can significantly affect your insurance rates in the city of Las Vegas. The even more complete your coverage, the greater your insurance costs might be. Insurance providers normally take into consideration the threat aspects related to covering teen vehicle drivers, that are often considered as risky because of their lack of driving expertise. When requesting an insurance quote, it's important to be actually familiar with exactly how these factors can easily influence your general insurance rates, especially in a bustling city like Las Vegas.

Additionally, variables like getting a website traffic ticket or residing in a particular ZIP code within the city can additionally influence your auto insurance rates in Las Vegas. Tickets and also infractions may show a greater threat degree to insurance companies, potentially triggering a boost in costs. Additionally, the place within the city where you reside may affect your insurance rates; locations along with greater crime rates or occasions of automotive fraud may cause greater insurance policy premiums compared to even more safe and secure areas. It is actually important to be watchful of these elements when browsing the world of auto insurance in Las Vegas to guarantee you find a policy that suits both your requirements and also budget.

Driving History as well as Its Effect On Prices

Your driving history participates in a pivotal duty in figuring out the rates you'll pay for car insurance coverage in Las Vegas, NV. Auto insurance companies thoroughly assess your past actions when driving to assess the degree of risk you give as a driver. Events such as at-fault collisions, web traffic offenses, and Dwis can considerably enhance your monthly premium. Meanwhile, responsible vehicle drivers with a clean record may receive insurance discounts as well as reduced costs. When it involves choosing coverage limits, your driving history may also influence the price of additional coverage like property damage liability and also bodily injury protection. Aspects such as the frequency of insurance claims and also extent of past cases bring about just how auto insurance companies determine costs for vehicle drivers in Las Vegas, irrespective of sex.

Knowing how your driving history affects your auto insurance coverage is actually crucial when looking for cheap rates in Las Vegas, NV. By preserving a clean driving record as well as staying away from crashes and transgressions, you may display to insurance companies that you are actually a low-risk vehicle driver, likely triggering lesser fees. It is crucial to evaluate your policy on a regular basis to guarantee you have the correct amount of coverage based upon your driving habits and also record. By being actually positive and bring in notified choices about your auto insurance, you can take management of your fees and also safe and secure enough protection on the Las Vegas roadways.

Motor Vehicle Kind as well as Insurance Costs

When it relates to the relationship between the sort of vehicle you drive and your insurance coverage costs in Las Vegas, many aspects happen into play. As an example, deluxe cars or high-performance vehicles generally possess greater insurance coverage premiums as a result of their pricey repair costs and higher likelihood of burglary. However, cars equipped along with innovative protection attributes like anti-theft devices or driver aid modern technology may apply for discounts on insurance policy premiums.

Additionally, your automobile's make, model, as well as year can impact your insurance rates in Las Vegas. Vehicles that are extra vulnerable to crashes or burglary may lead to much higher costs. It is vital to take note that the state of Nevada requires motorists to hold a minimum required volume of insurance coverage, consisting of bodily injury liability and also property damage liability. Knowing how your vehicle type influences your insurance coverage costs may aid you create informed decisions to secure affordable auto insurance rates that straighten along with your budget plan and also driving necessities.

Just How Your Las Vegas ZIP Code Influences Your Premium

When it concerns auto insurance rates in Las Vegas, your ZIP code plays a considerable part in determining the cost of your premium. Insurance companies consider a variety of variables when calculating your fee, including the site where your motor vehicle is largely parked. Specific areas in Las Vegas may have greater rates of accidents or auto theft, leading insurance companies to adjust fees as needed. This is why it is actually important to understand exactly how your Las Vegas ZIP code determines your premium so you can easily create educated selections when selecting coverage levels and service providers in the location.

Moreover, the coverage availability can easily vary based upon your Las Vegas ZIP code, influencing the price of your premium. Elements like the amount of uninsured vehicle drivers in your place can easily impact the costs for uninsured motorist coverage. Likewise, if your ZIP code possesses a past history of accidents leading to bodily traumas, insurance companies might change prices for bodily injury coverage. Recognizing exactly how your site affects coverage selections can easily assist you browse the insurance policy market successfully and discover the right equilibrium in between price and protection, specifically if you possess had a lapse in coverage.

Tips to Find Cheap Auto Insurance in Las Vegas

When searching for cheap car insurance in Las Vegas, it is actually important to know the relevance of liability coverage. Ensuring you comply with the minimum coverage requirements set through Nevada rule is actually necessary. Liability coverage limits differ, however contending least the minimum coverage in location can help keep your prices affordable. Factors such as driving history and also age may influence insurance rates for vehicle drivers, especially for younger individuals like 20-year-old vehicle drivers. Recognizing the possibilities on call for motorists, particularly single motorists, is actually crucial to deciding on a suitable auto insurance policy.

When looking into means to find cost-effective auto insurance in Las Vegas, think about choosing a minimum-coverage policy if it lines up along with your needs. Matching up quotes from different companies can easily help you determine the greatest rates for your situation. Making the most of discounts and also bundling companies may also lead to savings. Bear in mind that readjusting deductibles may impact superiors, as well as researching the top car insurance policy providers in Las Vegas, NV, can easily help you in creating an educated decision when aiming to switch over insurance policy providers.

Contrasting Quotes coming from Several Companies

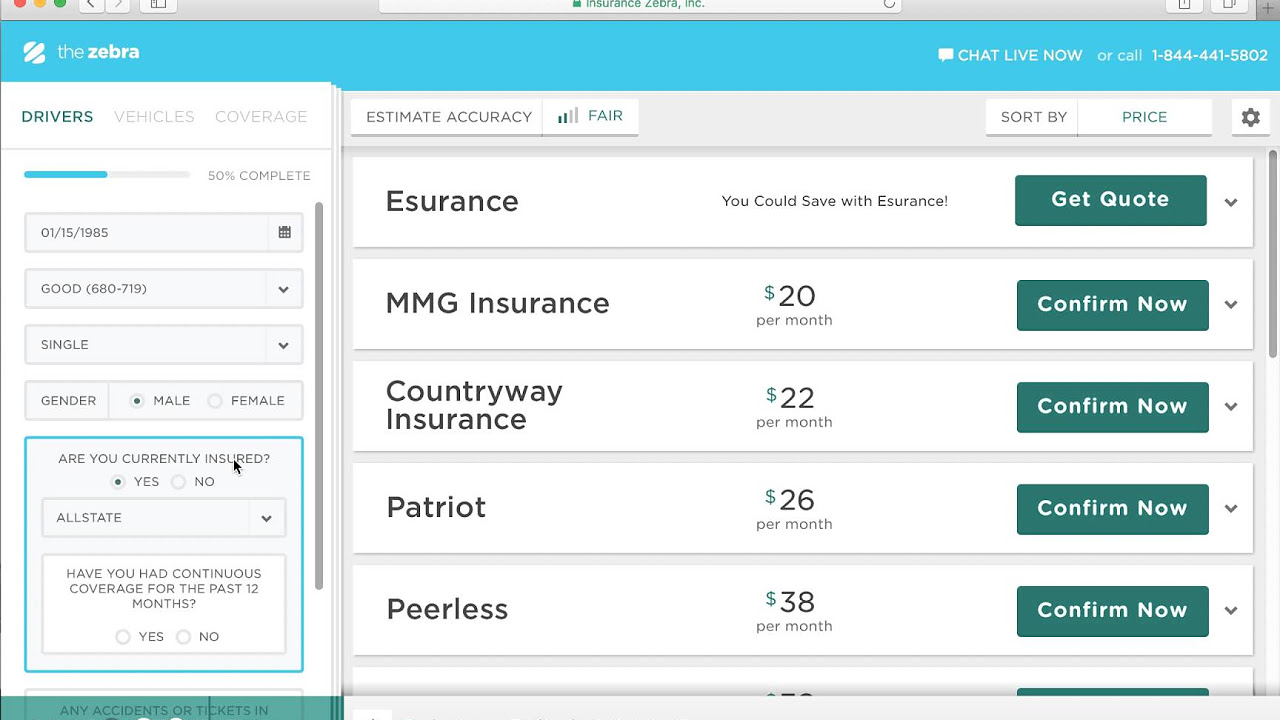

When reviewing auto insurance possibilities in Las Vegas, consumers typically find it good for compare quotes coming from a number of suppliers. By obtaining personalized quotes from various insurance providers, individuals can easily get ideas into the varying superiors provided based upon aspects such as driving history, safe driving habits, and the form of coverage needed. As an example, drivers along with a clean record might be qualified for reduced superiors matched up to those along with previous website traffic violations or even mishaps on their record.

Also, the cost of auto insurance can also be influenced through variables such as repair costs, student discounts, and also also credit scores. Insurance companies might deliver discounts for teen drivers who accomplish driving training programs or even comply with certain rules referring to youthful motorists. Furthermore, bundling policies like home and also automotive coverage can easily usually lead in multi-policy discounts, which may help in reducing the annual cost of insurance policy costs. By matching up quotes totally and also taking into consideration all on call discounts, individuals in Las Vegas can easily create educated choices about selecting the very most cost-efficient and also suited auto insurance policy for their requirements.

Benefiting From Discounts as well as Bundles

When it pertains to getting the greatest offer on auto insurance in Las Vegas, benefiting from discounts as well as bunches may significantly lower your fees. Auto insurers commonly deliver discounts for numerous reasons, including possessing a secure driving record, packing multiple policies, or even insuring multiple vehicles. Through discovering these choices, you can likely spare a considerable volume on your car insurance policy.

Additionally, some insurance policy providers might provide discounts based upon your customer satisfaction score. Companies like J.D. Power determine and rank insurance providers based on client responses as well as contentment levels. This may provide you a clearer concept of the quality of service you may count on coming from a certain insurer. Furthermore, the form of motor vehicle you drive may likewise determine the discounts you may be entitled for, especially when it relates to safety and security components as well as collision protection. As an example, if your auto has actually evolved safety and security attributes, you might receive reduced superiors. Always remember, even having a single speeding ticket can influence your prices in the largest city in Nevada, thus sustaining a clean driving record is actually critical for securing the finest insurance bargains.

The Task of Deductibles in Reducing Costs in Las Vegas

When it pertains to auto insurance coverage in Las Vegas, Nevada, knowing the part of deductibles is important in handling your superiors. A tax deductible is the quantity you accept pay of wallet just before your insurance coverage pitches in to cover the remainder of the expenses in case of an insurance claim. Going with a greater tax deductible may lower your costs as insurance companies observe you as much less of a risk given that you want to cover a much larger portion of the costs your own self. Having said that, it is actually vital to ensure you can easily manage the decided on deductible amount in the event that of an accident. Being actually prepped along with savings or access to funds is actually essential to stay clear of any economic stress eventually of demand.

Auto insurance costs could be significantly impacted due to the insurance deductible you decide on, in addition to other variables including your driving history, motor vehicle style, as well as ZIP code in Las Vegas, NV Comprehending the connection between deductibles and premiums can assist you create informed decisions when picking an insurance policy. It's advisable to weigh the cost savings of a higher insurance deductible versus the prospective financial worry in instance of an accident. Through contrasting quotes coming from different providers like Travelers, Mercury Insurance, as well as others, you can easily discover the cheapest car insurance rates that line up along with your needs and also budget while thinking about the function of deductibles in managing your premiums efficiently.

Leading Car Insurance Coverage Service Providers in Las Vegas, NV

When searching for car insurance companies in Las Vegas, NV, it is very important to review the possibilities accessible to discover the most effective coverage for your necessities. A number of insurance policy the leading car insurance companies in Las Vegas promotion very competitive costs for liability insurance, which is required in Nevada. Liability insurance assists deal with the costs of loss and personal injuries received by others in an accident for which you are actually at fault. It's vital to consider liability limits when picking a policy, as these limitations figure out the maximum amount your insurer will purchase damages every accident, injury each, and injury per accident.

In Las Vegas, the best car insurance suppliers also provide continuous insurance discounts for insurance holders that sustain coverage without any kind of . When comparing sample rates coming from different firms, be sure to inquire concerning discounts that may administer to you. Some insurance carriers in Las Vegas may possess the cheapest rates for vehicle drivers with well-maintained driving documents, while others might supply lower prices for those with a history of no insurance claims or even accidents. Comprehending the factors that influence rates of accidents as well as claims in your area may aid you create an informed selection when selecting a car insurance company in Las Vegas, NV.

Just How to Shift Auto Insurance Policy Providers in Las Vegas

When considering switching car insurance carriers in Las Vegas, it is important to first testimonial your existing policy to know the coverage you presently have. Analyze if you are actually meeting the minimum level of insurance demanded by the condition of Nevada, which consists of liability coverage for bodily injury as well as home harm. Also, analyze if you have uninsured motorist coverage in spot to guard your own self in case of a mishap with an uninsured motorist. By understanding your current policy, you can easily a lot better match up quotes from different suppliers in the city.

It is wise to look into the citywide average auto insurance rates in Las Vegas to possess a benchmark for contrasting quotes coming from different suppliers. Bear in mind that elements such as your driving history, motor vehicle type, as well as ZIP code can easily affect the fees provided through insurance companies in the place. When you have compiled various quotes, analyze the coverage options, discounts, as well as consumer reviews to make an informed choice when shifting auto insurance carriers. Keep in mind to alert your present insurer prior to creating the button to prevent any gaps in coverage.